Woodland Creation and Expansion for Carbon Sequestration and Habitat Improvement

Tilhill Forestry and CarbonStore, working closely with the farmer, designed and implemented the woodland creation plan at Accurrach.

Read more“There has never been a better time to plant a tree.” Appreciation for Natural Capital is gathering momentum. The value of woodland carbon is rising. The perceived ecological and environmental value of woodlands is growing. These new markets are offering new and powerful incentives for planting trees.

Recent dynamics in the forestry industry suggest landowners, be they local authorities, farmers, universities, public bodies, or private estates, should consider an alternative but equally compelling reason to heed the advice of this often used saying.

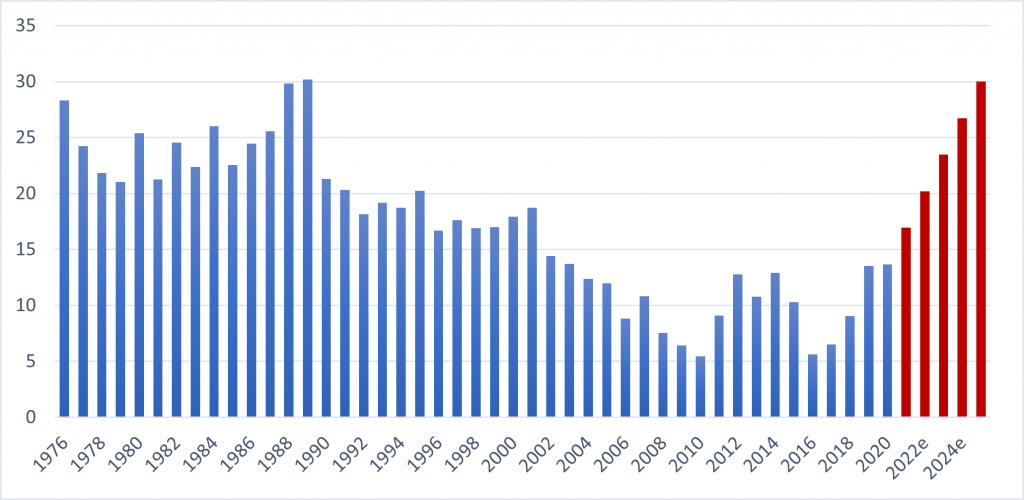

According to the Forestry Commission’s recently released statistics, the UK planted 13,660 hectares of new woodlands in the 12 months to 31st March 2020 (see chart 1). Although this represented a steep rise from the nadir of just 5,610 hectares in 2015 (see chart 1), it still falls far short of the government’s target for 30,000 hectares annually from 2025, to which it is committed in its manifesto.

Chart 1: Area of New Woodland Creation in the UK, 1976-2025 (forecast), ‘000 hectares

The government therefore has 4 years to lift annual woodland creation by 2.2x back to a level it has achieved just once in the past 40 years. It must then maintain that level every year for the next 25 years. This would represent an unprecedented injection of new demand to the UK’s forestry industry, the scale of which is even more marked when considered at a country specific level.

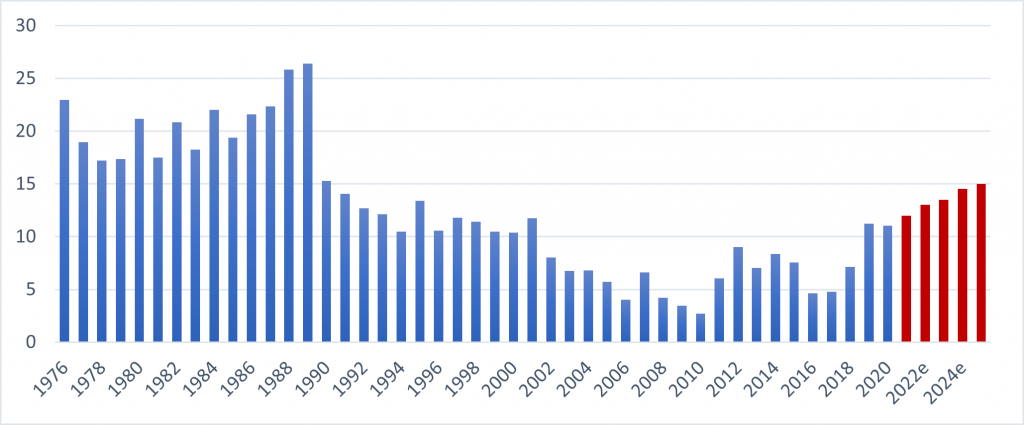

Scotland dominates tree planting in the UK. Between 1976 and 2020, 73% of all new woodlands across the UK were planted in Scotland. The SNP’s target, to plant 15,000 hectares annually from 2025 (see chart 2), accounts for 50% of the UK’s overall goals and they seem to be on track to achieve that.

Chart 2: Actual and Targeted Woodland Creation in Scotland, 1976-2025 (forecast) ‘000 hectares

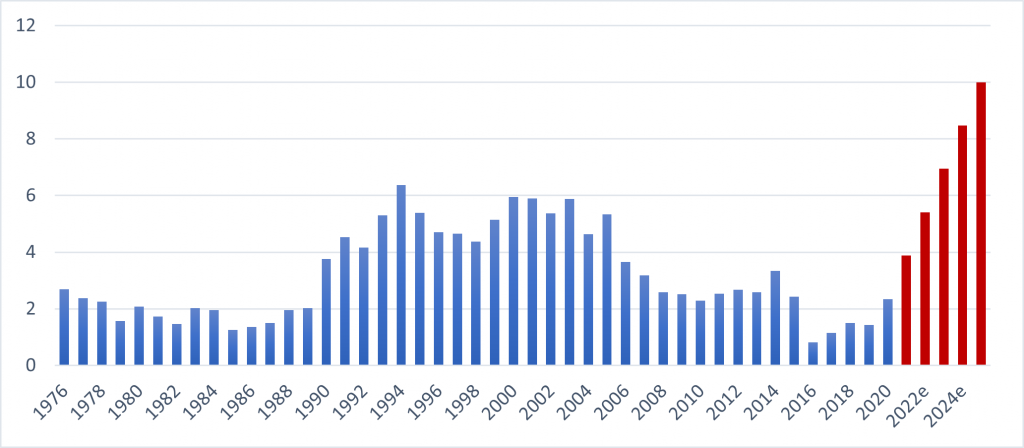

Chart 3: Actual and Targeted Woodland Creation in England, 1976-2025 (forecast) ‘000 hectares

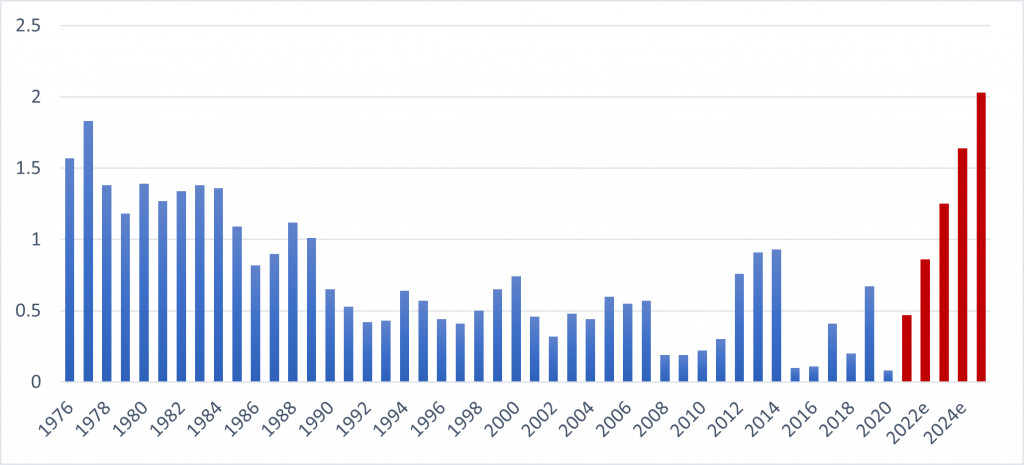

Chart 4: Actual and Targeted Woodland Creation in Wales, 1976-2025 (forecast) ‘000 hectares

Through 2018 and 2019, the Scottish government allocated large sums of public money to boost woodland creation. These subsidies have borne fruit. In 2017/18, just 4,760 hectares of new woodlands were planted across Scotland however, by 2019/20, that figure has increased 132% to 11,050 hectares.

Over the next 4 years, Scottish tree planting volumes therefore need to rise a further 36% in order to achieve the SNP’s target of 15,000 hectares per year from 2025. Steady, incremental growth in tree planting activity across Scotland is necessary to realise the government’s objectives.

In contrast, a revolution is needed across England and Wales if their governments are to achieve their widely touted objectives. 2019/20 saw just 2,340 hectares planted in England and a paltry 80 hectares in Wales. Both figures fall far short of their targets for 10,000 hectares and 2,000 hectares from 2024/25 respectively.

As new planting volumes rise in the coming years, all segments of the woodland creation supply chain will need to expand in order to accommodate these giant chunks of additional demand. Indeed, various signs are already emerging to show that capacity rates are rising across the industry, especially in Scotland.

As discussed earlier, Scotland has witnessed particularly strong growth in planting volumes recently. In 2019/20, the area of new woodland created (11,050 hectares) was more than 60% above the 20-year average of 6,800 hectares. As a result, supply/demand dynamics are tightening.

One experienced industry observer commented that they had never seen this level of enquiries in 25 years’. A well-informed forest manager recently noted that the high volume of demand was offering scope to cherry pick their orders and concentrate on the more lucrative opportunities.

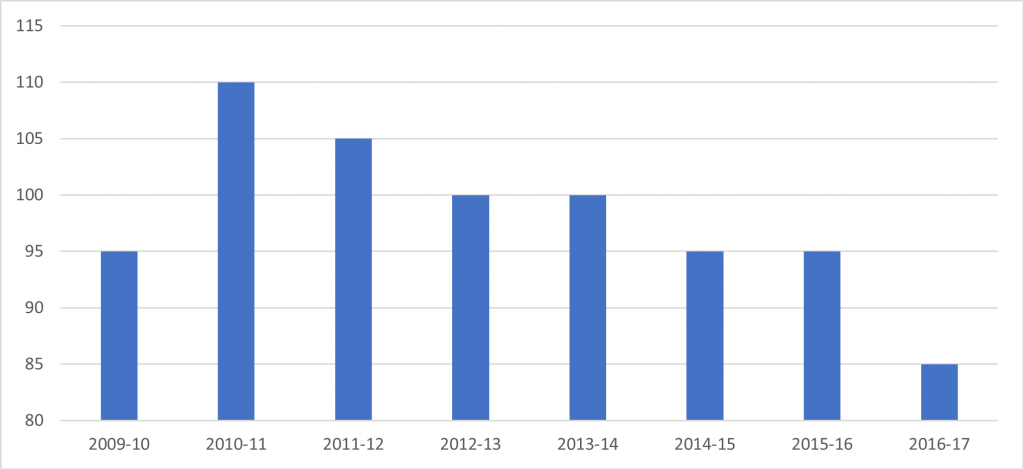

With demand continuing to rise, these nascent tensions are likely to intensify in coming years. Properly trained and educated forestry graduates are essential to ensure high standards of woodland creation across the industry. According to the Higher Education Statistics Agency, the number of university leavers entering the forestry industry has fallen consistently since 2010/11 (see chart 5).

Chart 5: Number of University Leavers Entering Forestry and Logging in the UK, 2009-2017

A forest manager needs at least 5 years of academic and practical education before they are properly equipped to oversee the planting and establishment of a new woodland. This decline in properly trained new entrants to the forest management sector is coinciding with a rise in demand for their services and could create challenges both for forestry companies undertaking new planting contracts and landowners wishing to implement them.

Shortages of skilled digger operators, able to prepare competently the ground for planting, are also apparent. Moreover, they are an aging demographic who, like forest managers, take time to train up. As the demand for their skills grows and the availability of their services is restricted by the retirement of existing operators, order books and lead times for the machinery contractors are likely to expand.

The planting gangs, who manually plant the young trees in the ground, are heavily comprised of hard working eastern European workers. It is unclear whether Brexit will undermine access to this valuable and important source of labour for the forestry industry but it is a risk of which many are acutely aware.

All participants across the industry must be careful that demand-led pressures don’t compromise its high standards. Fast growing markets operating close to full capacity inevitably attract opportunistic entrants who lack the necessary skills, experience and care to ensure a young plantation matures into a healthy and attractive woodland.

Any landowner wishing to plant up their land, enhance their Natural Capital and leverage the woodland carbon market should recognise these growing, capacity-related risks. Scarce supplies of and strong demand for woodland creation expertise could see contract delivery times lengthen so that some, more impatient landowners are forced to sacrifice standards and engage with more recent, less experienced and less qualified entrants to the forestry sector.

Any objective assessment of both the industry and the company will show that Tilhill is uniquely well-placed to help protect all types of landowners against these very real risks facing woodland creation projects. In 2020, the company recruited a record number of foresters onto its graduate programme.

Moreover, Tilhill has over 70 years’ experience planting woodlands of all types across the UK and employs the largest number of ICF chartered foresters of any organisation. These foresters all care deeply about the health of our woodlands, the quality of their work and the satisfaction of their clients.

Tilhill has an enviable reputation of award-winning standards in woodland creation, woodland management and health and safety. Its nationwide network of offices ensures its ability to deliver clients’ needs across all corners of England, Scotland and Wales.

Tilhill can also secure ample supplies of home-grown, disease-free young trees for its clients. It is partnered through CarbonStore with Maelor Forest Nurseries, a leading UK tree nursery that is currently implementing a major expansion project to ensure its supplies match its clients’ growing order volumes.

Finally, through CarbonStore, Tilhill can provide landowners with the knowledge and contacts necessary to access and monetise their woodland-generated carbon units so that they secure a fair and transparent price for an increasingly valuable commodity. This all-in-one package is both cost-effective and convenient.

For both the landowning community and the forestry industry, these are exciting and promising times. However, the sudden resurgence of demand across an industry which, before 2016/17, had witnessed 27 years of almost relentless decline (see chart 1) requires careful yet decisive navigation.

The attitude taken by the estate’s director of a large real estate company neatly summed up the best path forward. He wanted to get on with the job, he knew his competitors were all developing similar plans and he wanted to get his contracts secured before them. And, he added, “You’re the best out there.”