Woodland Creation and Expansion for Carbon Sequestration and Habitat Improvement

Tilhill Forestry and CarbonStore, working closely with the farmer, designed and implemented the woodland creation plan at Accurrach.

Read moreThe Woodland Carbon Code has now announced the widely-discussed changes to its additionality test which all projects applying for carbon funding must pass.

The additionality test evaluates whether carbon funding is an essential element in a woodland’s viability (and therefore its development). As such, the test scrutinises whether a newly-planted woodland is a genuine off-setting project whose profitability is reliant on selling the carbon credits or whether it would have been planted irrespective of carbon funding.

Until now, the Code’s additionality test has enabled a reasonable level of flexibility (e.g. on timber prices, discount rates, establishment costs etc).

From 1st October 2022, that will change because the new test adopts a standardised and rigid approach when assessing the significance of carbon funding on a planting scheme’s viability. This has various implications:

With the 1st October 2022 deadline rapidly approaching, many schemes which have been designed for carbon funding but will knowingly fail the new, more rigorous test, are working hard to beat the deadline and submit their documents for validation before the end of September. This may have an influence on pricing trends over the next 12 months.

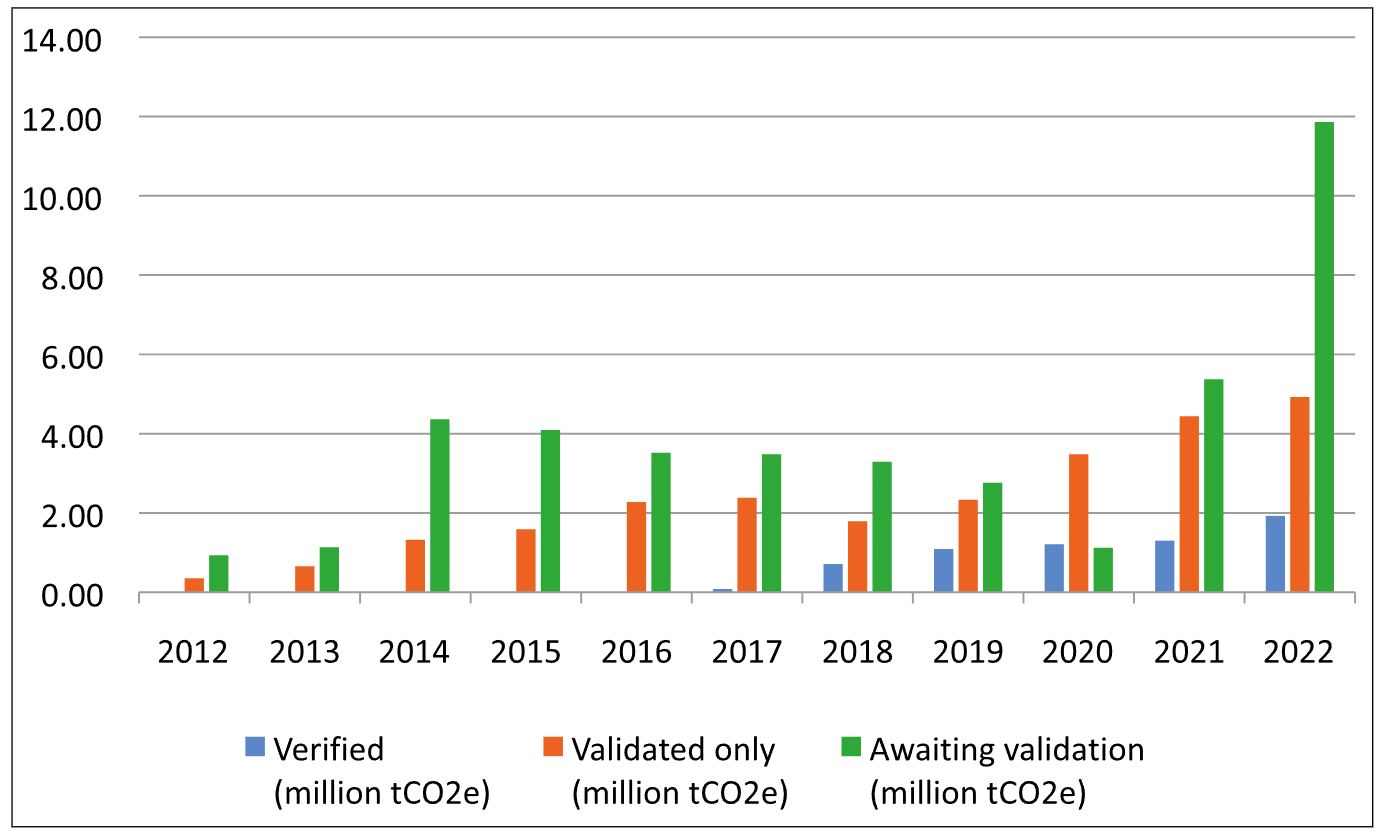

The projected sequestration capacity of planting projects which have registered with the Woodland Carbon Code has increased almost 10-fold since 2020, from 1.12mn tonnes in March 2020 to 11.86mn tonnes in March 2022 (see chart 1 below). As these projects are validated, the volume of Pending Issuance Units (PIUs) available for sale will rise steeply.

Usually, projects have three years from the date of registration to submit themselves for validation. However, with the risk that many of these registered projects will fail the new test means that the number of projects and PIUs being validated, issued and offered for sale in the next 6-8 months is likely to rise steeply.

The impact of this imminent supply growth will be interesting to watch. No doubt, prices have been firm recently. Back in April, when the Woodland Carbon Code asked project developers for indicative prices to apply for the new additionality test, they ascertained £15 per PIU as the “mid-point of informal feedback from project developers” i.e. the price which landowners are receiving.

Since then, prices have continued to rise. The Farmers’ Guardian is currently quoting prices around £17 per PIU and we recently learned of one operator offering £18 and another offering £20 per PIU to the owners of two different schemes close to Edinburgh. Meantime, demand remains robust and rising with recent enquiries emerging for bulk demand of 20,000 PIUs and larger.

As the market for woodland carbon evolves, it is becoming increasingly complicated to understand which type of service and which company offers the best value for money.

There are two basic services which companies offer in relation to woodland-generated carbon units with the Woodland Carbon Code:

This work involves registering, validating, and verifying a woodland, according to the Code’s rules. In practice, there is a large amount of detailed bureaucratic and administrative work required in the registration and validation process. Woodland owners can therefore save significant time and cost by outsourcing this work to a company, such as CarbonStore, which has the skills and knowledge to undertake this work accurately and efficiently.

This service is provided to the woodland owner once the project has been validated and the PIUs issued. It involves marketing and selling the PIUs to companies looking to buy carbon credits to offset their carbon emissions. In practice, it involves agreeing signage and access rights (depending on the service provider – see opposite) and the signing of legal contracts which clearly outline the responsibilities and obligations of the woodland owner selling the PIUs and the company buying them.

The way in which companies deliver and charge for these services can be obscured by the various packages offered by different companies. In practice, there are two basic types of services with any variations around these basic models usually being a blend of the two:

Under this approach, a company will wrap the two services into one single offering. They will register, validate and verify the woodland (ostensibly at no cost to the woodland owner) and, as part of this service, will also secure the rights to sell the PIUs once they have been validated. The company will agree a price per PIU which they pay to the woodland owner (upon validation) and they will then earn their profit by achieving a mark up between the price paid to the woodland owner and the price charged to the company buying the PIUs.

Recent commentary from woodland owners and companies suggests that mark up could be around 25-30%. Given that the ‘Project Developer’ costs are fixed while the profit earned from the ‘Brokerage Services’ depend on the size of the project, the profits earned by companies from providing this type of ‘bundled’ service are greatest on larger projects.

CarbonStore operates under this transparent approach which involves a woodland owner paying a pre-agreed and standardised fee for the different services required. As such, the time taken for the Project Developer to register, validate and/or verify a woodland are all charged separately and the costs (and potential income) from the carbon funding are outlined before any work starts.

Once the PIUs are issued, the woodland owner can then choose how many PIUs they wish to sell and when to sell them. The process of selling the PIUs under this approach is different from the bundled offering as the woodland owner agrees a price per PIU with the company alongside the level of signage and access rights which they are comfortable granting to the buyer.

The charge for the ‘brokerage service’ under this, more transparent approach is a percentage-based commission fee on the total value of the transaction. As a result, every party in the transaction understands the price being paid and received and the charges being levied.

CarbonStore wants to maximise the options available to woodland owners as to how many PIUs they sell and when they sell them. We believe it is essential that woodland owners can tailor the signage and access rights according to their preferences.

Finally, we consider it essential that the costs and benefits from selling woodland carbon credits are equitably apportioned between the two key parties in any transaction i.e., the woodland owner and the corporate. No doubt, the broker plays an important role in facilitating the transaction however the value of that service is insufficient to justify profit margins which, in some cases, may exceed 80%.

Through the autumn and winter, CarbonStore, in partnership with a well-known and highly regarded estate, will be auctioning the PIUs generated from an outstanding example of naturally regenerating native woodland. If you have any questions on the above, please feel free to contact me personally via email at david.mcculloch@carbonstoreuk.com

If you would like to know more about our services and how we work with corporate clients, then please sign up for our free webinar taking place on 29th September at 10.00 am.