Woodland Creation and Expansion for Carbon Sequestration and Habitat Improvement

Tilhill Forestry and CarbonStore, working closely with the farmer, designed and implemented the woodland creation plan at Accurrach.

Read moreA new year and a fresh start are always a good moment to reflect on the year just finished and look ahead to the one in front. What were the major milestones in 2021 and can we learn anything from them about what lies in store for 2022?

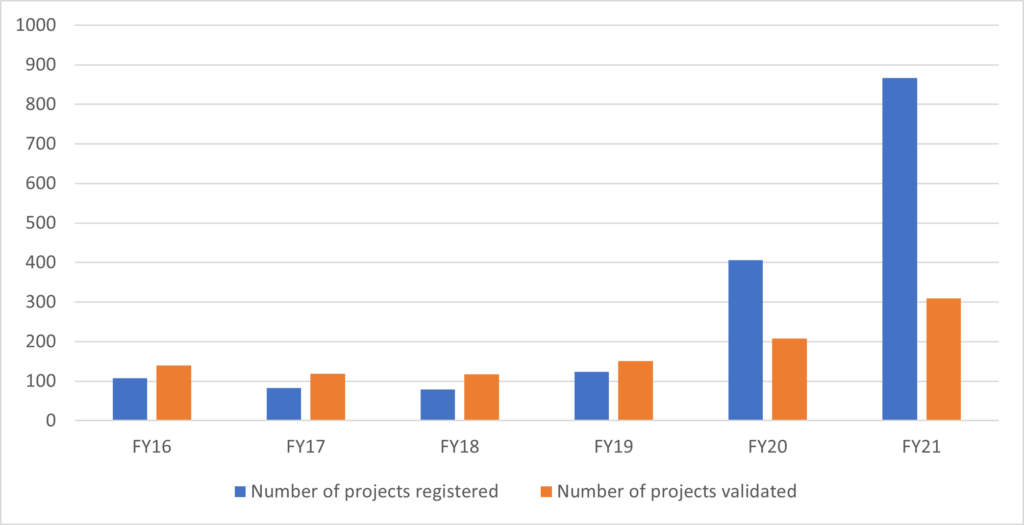

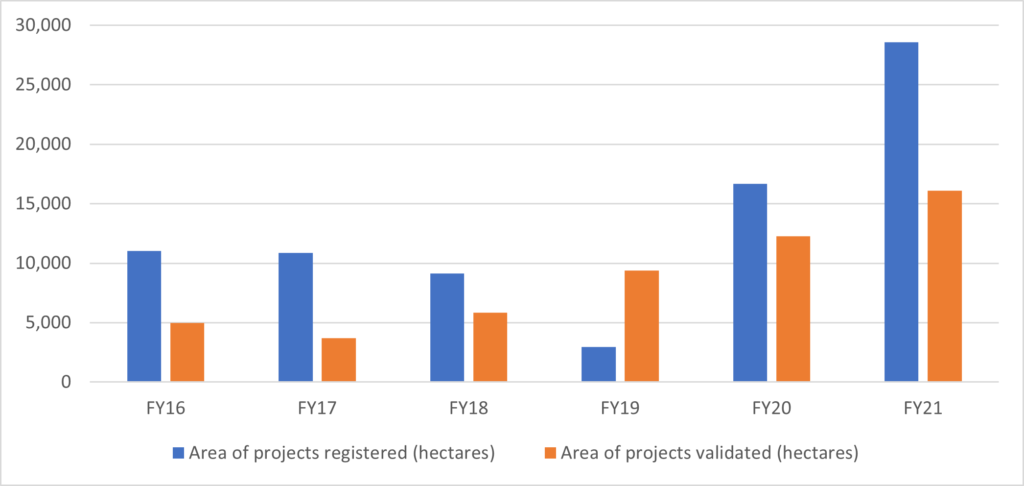

The most striking feature of 2021 was the growing momentum across every element of the market for woodland carbon. The number of projects registered with the Woodland Carbon Code surged (see charts 1 and 2 below), the level of corporate demand increased and the prices of PIUs and WCUs continued to climb.

Rising activity has inevitably brought increased demands across the whole industry. As chart 1 shows, the backlog of projects which have been registered but are awaiting the more time-consuming process of validation has grown significantly. Among the organisations responsible for validating and regulating the projects, the Woodland Carbon Code has increased their team and the validators have also recruited new people.

Private sector companies are also capitalising on the opportunities presented by both the Woodland Carbon Code and the Peatland Code. The paperwork necessary to register and validate projects is laborious, bureaucratic, and complicated. New companies have also entered the market offering innovative approaches and alternative services.

Most importantly, corporate demand for carbon credits has continued to grow and therefore provided an important stimulus to these various trends. According to Ecosystems Marketplace (EM), the value of carbon credits on the global voluntary carbon market rose 60% YoY between January and August 2021. Moreover, the value traded exceeded $1bn for the first time in 2021. As EM noted:

“The combined value of those deals is becoming a serious source of finance for green projects around the world.”

Rising corporate demand has also been an important factor supporting prices for voluntary carbon credits both globally and here in the UK. The KraneShares Global Carbon Strategy ETF is benchmarked to IHS Markit’s Global Carbon Index and tracks the most traded carbon credit futures contracts. Since January 2021, its share price has increased x2.14.

Prices for UK-based woodland-generated carbon credits also increased through 2021, albeit not as steeply. A native planting scheme in Argyll secured £13.50 per PIU back in June but is now seeking £16-£17. Back in March, productive conifer woodlands in southern Scotland were securing prices around £13 per PIU but those have now climbed to £15.

Projects in England have also enjoyed inflating prices for their PIUs. In March we highlighted a native planting scheme in Northumberland seeking offers ‘above £15 per PIU.’ The carbon from that project was eventually purchased around £18. Prices are stronger yet in southern England. A newly planted broadleaf woodland in Essex is taking offers over £22 per PIU.

The most sought-after units remain verified WCUs. With just 99 projects having undergone their year 5 verification and only one to have passed its year 15 inspection, there are a limited number of WCUs available. Indeed, this is exacerbated by the reluctance of many to sell, however we have recently seen offers above £40 for verified WCUs which is understandably attracting more supply.

Should we expect prices to continue their ascent in 2022? They have increased dramatically since 2019 when offers around £2 per PIU were secured on broadleaf planting schemes in central Scotland. On the one hand, supply is likely to rise over the next 12 months as those projects which have been registered (see charts 1 and 2) prepare their Project Design Documents, undergo validation and (all being well) are issued with PIUs.

There are also a number of ‘natural sellers’ out there who own validated PIUs and are waiting to see how much further prices can climb but will be keen to sell on any signs of a pull back. Any correction would also be a good test of the resolve among those predicting £60 or higher for carbon prices.

Pricing trends are most likely to depend on corporate demand. Will it be sufficient to absorb the growth in supply? With the purchase of woodland-generated carbon credits still only a voluntary undertaking, demand will be influenced by a) the vigour of companies’ environmental consciences and b) their ability to cover the cost of alleviating them i.e., the size of their profits.

Encouraged by its endorsement from the International Carbon Reduction and Offset Alliance (ICROA) in March and keen to maintain its credibility as a carbon offsetting standard, the Woodland Carbon Code continued to scrutinise its regulations and tighten its rules last year.

From July 1st 2021, it ruled that all schemes seeking carbon funding must be registered with the Code before planting starts. To tighten and clarify its eligibility criteria, the Code also started to review its additionality test, the results of which are due to be announced in late January and will warrant close attention from those looking to secure both timber and carbon income from any new planting schemes.

In addressing the issue of additionality, it will be interesting to see how the Code accommodates the government’s statement, made on January 6th when they announced the new Environmental Land Management Scheme, that:

“They will also not crowd out private finance for climate and environmental outcomes.”

Details released so far by the Code suggest that productive conifer woodlands may be ineligible for carbon funding. Such woodlands sequester more carbon than their broadleaved counterparts, they generate jobs and economic activity in remote rural areas and their timber income is a valuable source of private finance helping contribute towards climate-positive behaviour, namely tree planting, and their product, timber, is vital if we are to see a robust home-grown timber market in the future. We hope that unduly rigid rules do not jeopardise the UK’s future timber resources.

It will also be interesting to see how the various markets for natural capital start to interact with each other. The Biodiversity Credits Scheme, the Hedgerow Carbon Code, the Peatland Code and the UK Farm Soil Carbon Code are all emerging, alongside the Woodland Carbon Code, to help channel private finance into environmentally beneficial nature-based projects.

Many of these generate overlapping and/or complementary outcomes. For example, like young woodlands, newly planted hedgerows also sequester carbon, enhance biodiversity, improve water quality and reduce soil erosion. Eventually it would make sense for farmers and landowners, who are planting hedgerows, to be able to access centralised markets which pay them for the carbon, biodiversity, or nature-based benefits of their actions.

Finally, we are often asked when the right time is to sell PIUs. Some companies are advising woodland owners to hold on to their PIUs in the expectation that prices will rise much further. Others prefer to sell all their PIUs up front and reinvest the proceeds in their farm or another planting schemes. We believe the best maxim to follow is ‘hope for the best but prepare for the worst.’.

By using CarbonStore to market your PIUs, you can sell as many (or as few) of your PIUs as you wish, whenever you wish. With prices ranging between £14-£20 per PIU, woodland owners are already generating attractive returns from their planting projects. Accordingly, it would make sense to lock in some of these gains by selling a portion of your PIUs, perhaps 30% or 40% in this ‘known’ market timeframe.

That approach would not only generate some immediate tax-free income. It would capitalise on the rise in prices enjoyed over the past 2 years. Moreover, by holding onto the remaining 60%-70% of your PIUs, you would also benefit if prices continue to rise in coming year