The outlook for the woodland carbon market appears encouraging. Its regulatory standard, the Woodland Carbon Code, has used the lockdown gainfully to update its rules and guidelines, expand its capacity and widen its recognition among both landowners and companies.

With the UK now (slowly) emerging from the lockdown, pressure for a ‘green recovery’ is growing. That is likely to intensify as November approaches and Glasgow’s hosting of the UN Climate Change Conference (COP26) sharpens our awareness of environmental issues. It seems likely to be bolstered by the savings some people have been fortunate to accumulate through the lockdown.

Gathering Momentum

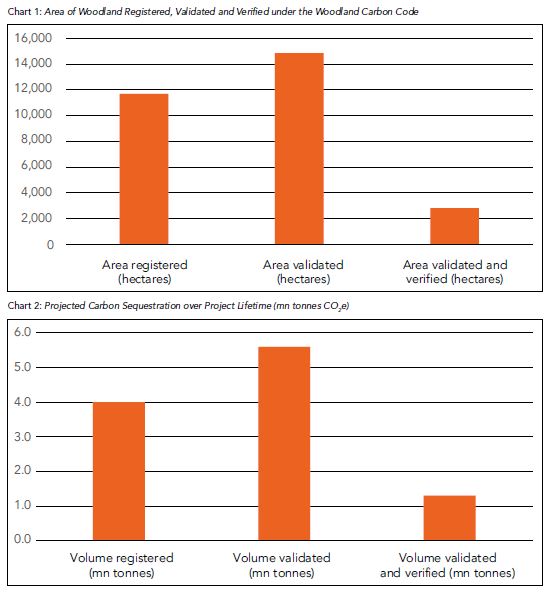

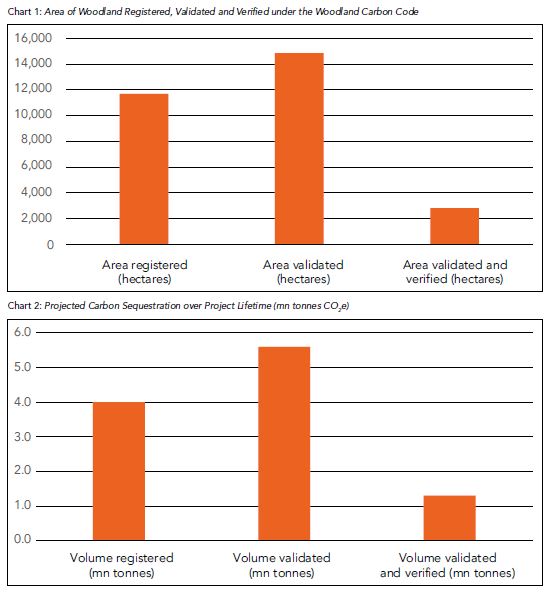

Accordingly, the woodland carbon market continues to gather momentum. This point is best illustrated by two statistics (see charts 1 and 2 below) published on the Woodland Carbon Code’s website. Since the code’s inauguration in 2011, it has overseen the validation of 14,876 hectares of woodland which has the potential to sequester 5.6mn tonnes CO₂e over the next 100 years.

In contrast, the area of woodland which, being registered under the Code, must be validated within the next 3 years amounts to almost 80% of hectarage which has already been validated since 2011. A comparison between the carbon sequestration potential of registered projects vs validated projects also suggests large supplies of saleable PIUs are likely to be issued by the Land Carbon Registry in the short and medium term.

Important Developments at the Woodland Carbon Code

March witnessed important developments both for buyers (i.e. mainly companies) and sellers (i.e. woodland owners) of woodland-generated carbon credits. On 10th March, the International Carbon Reduction and Offset Alliance (ICROA) “officially endorsed the Woodland Carbon Code into its Code of Best Practice.”

This is an important accolade for the Code from an internationally recognised institution. By certifying the Code’s processes and practices and lifting companies’ trust in the reliability of the offsetting claims implicit in PIUs and WCUs, it effectively enhances the value of those PIUs and WCUs. ICROA’s endorsement has another significant implication. The woodland carbon market has similarities with the Betamax/VHS videotape format struggle as various organisations are trying to develop their own carbon calculators and offsetting standards. The Woodland Carbon Code is already backed by the UK government and operated by Scottish Forestry but ICROA’s endorsement gives it an important stamp of international approval.

The Code also announced important changes for landowners. Until now, new woodland schemes could register within two years of planting being completed. From July 1st, that will change so that all schemes must be registered before any trees are planted. Please let us know if you need help registering any projects before July. The Land Carbon Registry can seem onerous but we can make this process easy and straight-forward for you.

Pricing Trends

The range of prices paid for PIUs remains broad and we hope, with improved transparency, this will narrow over time. The problems of opaque pricing were neatly illustrated in one report we heard recently. An English-based company with extensive experience in international markets is expanding its business to offer UK-based woodland carbon offsets. They were reportedly buying PIUs from landowners at less than £10 each before selling them onto companies for more than £20.

This seems to be both under-paying landowners and over-charging companies. Prices on conifer schemes in southern Scotland currently range between £12-£13 per PIU and broadleaf projects are earning roughly £15 each. This figure apparently rises towards £20 per PIU for broadleaf projects in England. We have a native scheme in Northumberland, CarbonStore Project CS011, likely to generate significant ecological benefits across the site, which is currently being planted and will soon be progressing through validation. The owner (quite reasonably) won’t accept prices below £15 per PIU for their 3,000 PIUs.

Finally, it is important to see the UK’s woodland carbon market within an international context. As a source of voluntary carbon credits, UK-based woodland carbon projects compete with cooking stove projects in Africa or REDD+ projects in South America for corporate offsetting demand.

The recent announcement, by a southern-based offset provider, that the cost of their standard carbon credit would rise 13% to £8.50, is significant. According to the accompanying press release, this was the first price increase for many years and reflected rising demand for carbon credits.

Beware of Killing the Goose Which Lays the Golden Egg

Unfortunately, rising issuance of PIUs does not necessarily mean their availability will grow in tandem. Last month, we explained that many expect prices of carbon credits to rise significantly as carbon offset markets develop. Many woodland owners are therefore holding onto their PIUs hoping that their values will increase.

Although this is understandable for an individual, the landowning sector in general must be careful not “to kill the goose that laid the golden egg.” Potential demand is strong but it relies on successfully procuring the necessary supply. If companies are unable to meet their offsetting needs in the UK’s woodland carbon market, they may look elsewhere. That would have serious implications for the UK’s tree planting targets.

Reducing the Bureaucratic Workload for Landowners

One final feature of the Woodland Carbon Code which landowners must be aware of is the volume and complexity of the paperwork and bureaucracy necessary to generate verified Woodland Carbon Units. The recently updated carbon calculator, the cashflow spreadsheet (to test the project’s additionality), the Project Design Document and the Project Progress Report all require time and knowledge to complete.

In addition, various commitments are asked of landowners. The Code requires landowners to sign its Landowner Commitment Statement. If a landowner wishes to save themselves (a lot of) time and effort by passing the Project Developer’s responsibilities to a third party, they must sign the Communications Agreement with the Land Carbon Registry. Finally, a sale of PIUs or WCUs requires a legal agreement with the acquiror.

At CarbonStore, we want this process to be straight-forward and readily understandable for landowners and companies alike and can help with all parts of the process. We can group projects to reduce costs. We can act as the Project Developer to reduce time. And we can offer knowledgeable and impartial advice on the Woodland Carbon Code.

We will shortly be publishing ‘The User’s Guide to the Woodland Carbon Market.’ We have created robust and fair legal contracts to codify the agreement between buyers and sellers of PIUs and WCUs. Finally, we have developed a sales process which achieves equitable and transparent prices for woodland carbon credits.

If you would like advice or support with any aspect of the Woodland Carbon Code or the wider market, please call or email us and we will be glad to help.